Contractor Score

KNOW THE SCORE

Contractor Score was developed as a tool to address an old challenge in the construction industry. Understanding the current financial capacity of a contractor and their ability to successfully fund work has not been easy.

Contractor Score is designed to have the familiarity of a consumer credit score, but the focus is on construction contracting.

How it is Used?

Contractor Score communicates the contractor’s financial capacity while maintaining their confidentiality. The score is used for prequalification, re-qualification or refinement to a contract’s terms’ and conditions. Owners, general contractors and anyone engaging a contractor will want to better understand the hired contractor’s financial position.

Regular updates to the score keep users apprised of the contractor’s current financial status. Many users request quarterly updates of their contractors to maintain an e ective project flow and keep everyone on schedule. Financially weak contractors are a major contributor to blown schedules and delayed projects. Contract defaults are costly to everyone even when secured by a bond or subcontractor default insurance.

How is Contractor Score Calculated?

There are over thirty metrics taken from the submitted information. An empirical algorithm, derived from years of experience in the industry as financial and management consultants, objectively measure the critical aspects of a contractor’s financial position.

The contractor’s latest year-end financial statement from either their outside CPA or their IRS tax return

Their most recent year-to-date internal financial statement

Their corresponding work-in-process

statement

Their line of credit information from their

bank

How is the Confidential Information Protected?

Confidentiality is a cornerstone to our business. Only a limited number of Contractor Score employees have access to the submitted information. All of the information is secured in locked safes and disconnected hard drives. All of the submitted information is destroyed thirty days after a certificate is generated. Only the subscribing contractor receives the score certificate. We never share scores unless they are made public by the contractor.

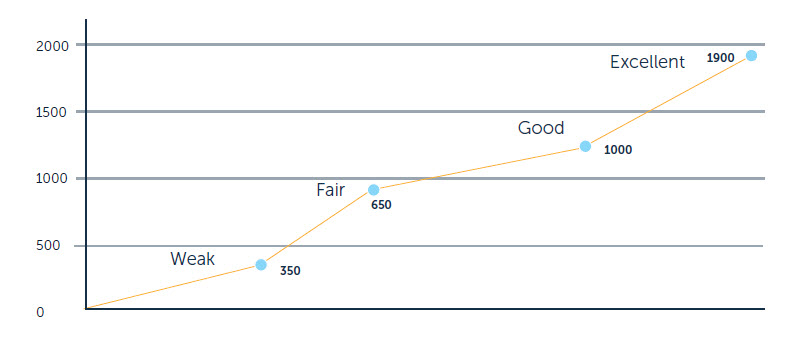

What is a Good Score?

The Survey

The matched individual survey results from the operational personnel with the identified contractor’s Contractor Score. Survey ratings were then put into the appropriate Contractor Score ranges.

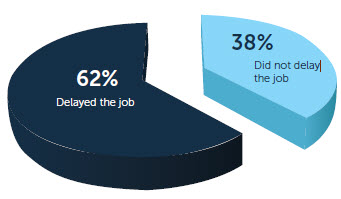

We tallied the responses and separated the contractors by Contractor Score into those above and below a score of 600. Those that scored below 600 caused a delay a majority (62%) of the time. As the Contractor Scores rose, the percentage of, “Yes”, answers (they delayed the job), decreased significantly. While there may be many reasons why delays occurred with lower scoring contractors, the results indicate a higher probability of delay may occur with lower scoring contractors. The 600 level score was chosen as that was approximately the break between contractors scoring at least the mid-point response, “Usually = 3” on the previous ten survey questions.

We tallied the responses and separated the contractors by Contractor Score into those above and below a score of 600. Those that scored below 600 caused a delay a majority (62%) of the time. As the Contractor Scores rose, the percentage of, “Yes”, answers (they delayed the job), decreased significantly. While there may be many reasons why delays occurred with lower scoring contractors, the results indicate a higher probability of delay may occur with lower scoring contractors. The 600 level score was chosen as that was approximately the break between contractors scoring at least the mid-point response, “Usually = 3” on the previous ten survey questions.

The Immediate Take-away

Our survey results show that contractors with lower Contractor Scores (below 600) did not rate as well in project performance as contractors with higher Contractor Scores (650 and up). The higher Contractor Scores show better and level project performance results. Basically, any Contractor Score over 1000 looks to perform equally. Obviously, this does not rule out a lower scoring contractor from performing admirably on any given job or a high scoring one behaving badly.

The Conclusion

Qualification of contractors is important. Both pre-qualification and re-qualification on a regular basis provide a stronger job performance for all participants. Financial positions change continuously and the smaller the contractor, the faster their financial picture can change. A re-examination of financial qualifications every six months is prudent and sometimes quarterly updates make sense.